How to map GSTR 1 vs GSTR 3B

GSTR-1, filed by the supplier, contains invoice-wise and category-wise details of all outward supplies made in a year

GSTR-3B is the summary return based on which tax is deposited by the supplier. It contains category-wise summary of both inward and outward supplies and tax payment details.

Now, the reconciliation of GSTR-3B and GSTR-1 is of utmost importance since GSTR-3B is a manual return, i.e. it is not auto populated on the basis of GSTR-1 and GSTR-2A. There might be instances where supplier has shown an invoice in GSTR-1 but has not paid tax on that invoice in GSTR-3B. GST department uses data analytics to reconcile GSTR-1 and GSTR-3B filed by a supplier. That means it automatically reconciles GSTR-1 with GSTR-3B and issues a GST notice for mismatches.

One of the main reason of the difference is, wrong calculation of revenue & tax liability at the time of filling GSTR-3B For a large business organisation, it is very common to have difference in Actual turnover & the turnover recorded in books. This may result in GST liability if turnover as recorded in books of accounts is less than the actual turnover. Again this may result in late payment of GST, which may lead to applicability of interest. Nominal difference in is still accepted, but large data gaps is matter of concern because this can result in heavy interest liability

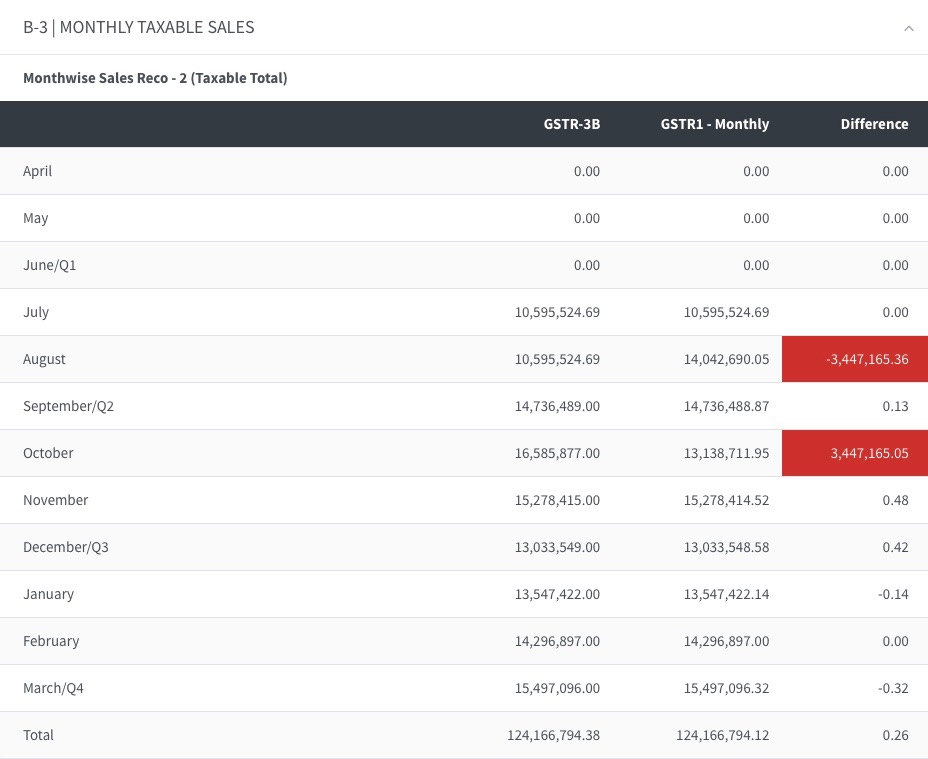

Here is a format for reconciliation

How to reconcile this difference value??

ReplyDeletewith your original database

Delete