Q.1 What is the need for the Place of Supply of Goods and Services under GST?

Ans. The basic principle of GST is that it should effectively tax the consumption of such supplies at the destination thereof or as the case may at the point of consumption. So place of supply provision determines the place i.e. taxable jurisdiction where the tax should reach.The place of supply determines whether a transaction is intra-state or inter-state. In other words, the place of Supply of Goods or services is required to determine whether a supply is subject to SGST plus

CGST in a given State or union territory or else would attract IGST if it is an inter-state supply.

Q.2 Why are place of supply provisions different in respect of goods and services?

Ans. Goods being tangible do not pose any significant problems for determination of their place of consumption. Services being intangible pose problems w.r.t determination of place of supply mainly due to following factors:

(i) The manner of delivery of service could be altered For example, telecom service could change from mostly post-paid to mostly pre-paid; billing address could be changed, billers address could be changed, repair or maintenance of software could be changed from onsite to online; banking services earlier required the customer to go to the bank, now the customer could avail service from anywhere;

(ii) Service provider, service receiver and the service provided may not be ascertainable or may easily be suppressed as nothing tangible moves and there would hardly be a trail;

(iii) For supplying a service, a fixed location of service provider is not mandatory and even the service recipient may receive service while on the move. The location of billing could be changed overnight;

(iv) Sometime the same element may flow to more than one location, for example, construction or other services in respect of a railway line, a national highway or a bridge on a river which originate in one state and end in the other state. Similarly, a copy right for distribution and exhibition of film could be assigned for many states in single transaction or an advertisement or a programme is broadcasted across the country at the same time. An airline may issue seasonal tickets, containing say 10 leafs which could be used for travel between any two locations in the country. The card issued by Delhi metro could be used by a person located in Noida, or Delhi or Faridabad, without the Delhi metro being able to distinguish the location or journeys at the time of receipt of payment;

(v) Services are continuously evolving and would thus continue to pose newer challenges. For example, 15-20 years back no one could have thought of DTH, online information, online banking, online booking of tickets, internet, mobile telecommunication etc.

Q.3 What proxies or assumptions in a transaction can be used to determine the place of supply?

Ans. The various element involved in a transaction in services can be used as proxies to determine the place of supply. An assumption or proxy which gives more appropriate result than others for determining the place of supply, could be used for determining the place of supply. The same are discussed below:

(a) location of service provider;

(b) the location of service receiver;

(c) the place where the activity takes place/ place of performance;

(d) the place where it is consumed; and

(e) the place/person to which actual benefit flows

Q.4 What is the need to have separate rules for place of supply in respect of B2B (supplies to registered persons) and B2C (supplies to unregistered persons) transactions?

Ans. In respect of B2B transactions, the taxes paid are taken as credit by the recipient so such transactions are just pass through. GST collected on B2B supplies effectively create a liability for the government and an asset for the recipient of such supplies in as much as the recipient is entitled to use the input tax credit for payment of future taxes. For B2B transactions the location of recipient takes care in almost all situations as further credit is to be taken by recipient. The recipient usually further supplies to another customer. The supply is consumed only when a B2B transaction is further converted into B2C transaction. In respect of B2C transactions, the supply is finally consumed and the taxes paid actually come to the government.

22.1 Place of Supply of Goods

Q.5 What would be the place of supply where movement of goods is involved?

Ans. The place of supply of goods shall be the location of the goods at the time at which the movement of goods terminates for delivery to the recipient. (Section 10 of IGST Act)

Q.6 What would be the place of supply wherein the supplier hands over the goods to recipient in his state and further movement is caused by the recipient?

Ans. The movement can be caused by supplier, recipient or any other person. Where the supply involves movement of goods, the place of supply shall be the location where the movement of goods terminates for delivery to the recipient.

Illustration: A person from Gujarat comes to Mumbai and purchases goods. He declared his Gujarat GSTIN, arranges transport himself and takes goods to Gujarat. The place of supply would be Gujarat in this case.

Q.7 What is the place of supply wherein movement of goods is not involved?

Ans. Where supply does not involve movement of goods, the place of supply shall be the location of goods at the time of delivery to the recipient.

Illustration: A in Mumbai has given his goods on lease basis to B in Delhi. After some time, the lessee B decides to purchase the goods. The supply takes place by way of change of title and no movement is required as the goods are already with the buyer. The place of supply is Delhi, the location of goods at the time of delivery.

Q.8 What will be the place of supply if the goods are delivered by the supplier to a person on the direction of a third person?

Ans. It would be deemed that the third person has received the goods and the place of supply of such goods shall be the principal place of business of such person. (Section 10 of IGST Act)

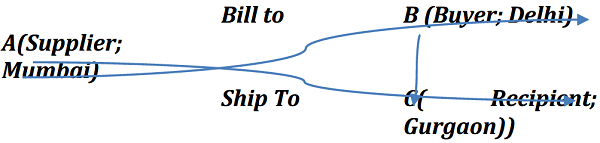

Such cases are termed as bill to ship to cases wherein the supplier sends the invoice to the buyer and the goods to the recipient on the direction of the buyer. Even though the goods are not received by the buyer, it is presumed that he has received the goods and he is able to take the input tax credit. The buyer may further issue his invoice to the actual recipient of goods. Thus, it is a tripartite arrangement wherein there are usually three parties and two transactions.

In the above case, goods go directly to C. The place of supply is location of B

| Location of Supplier | Location of third Party | Delivery of goods | Place of Supply |

| First Transaction between A and B with delivery to C |

| Mumbai (Maharashtra) | Delhi | Gurgaon (Haryana) | Delhi |

Q.9 What will be the place of supply where the goods or services are supplied on board a conveyance, such as a vessel, an aircraft, a train or a motor vehicle?

Ans. In respect of goods, the place of supply shall be the location at which such goods are taken on board. (Section 10 (1)(e) of IGST Act). For instance, if goods are taken on board at Vadodara, Gujarat on Rajdhani Express from Mumbai to Delhi. The place of supply shall be Vadodara, Gujarat.

However, in respect of services, the place of supply shall be the location of the first scheduled point of departure of that conveyance for the journey. (Section 12 and 13 of IGST Act)

Q.10 What is the place of supply in case of assembly or installation of goods at site?

Ans. The place of supply of goods, where the goods are installed or assembled at the site, will be the place of such installation or assembly. (Section 10(1)(d) of IGST Act)

Q.11 What is the place of supply of goods imported into India?

Ans. The place of supply of goods imported into India shall be the location of the importer.

Illustration: An importer from Jaipur, Rajasthan imports goods from China through Mumbai Air Cargo and declared the GSTIN of Rajasthan. The place of supply of goods shall be Rajasthan. Thus, the state tax component of the integrated tax would accrue to Rajasthan.

Q.12 What is the place of supply of goods exported from India?

Ans. The place of supply of goods exported from India shall be the location outside India.

22.2 Place of Supply of Services (Location of supplier as well as recipient are in India)

Q.13 What is the default presumption for place of supply in respect of B2B supply of services?

Ans. The terms used in the IGST Act are registered taxpayers and unregistered person. The presumption in case of supplies to registered person is the location of such person until and unless otherwise specified.

Q.14 What is the default presumption for place of supply in respect of unregistered recipients?

Ans. In respect of unregistered recipients, the usual place of supply is the location of the recipient, where the address on records exists. However, in many cases, the address of recipient is not available, in such cases, location of the supplier of services is taken as proxy for place of supply.

Q.15 What is the place of supply in case of services in relation to immovable property?

Ans. Any service provided directly in relation to an immovable property including services provided by architects, interior decorators, surveyors, engineers and other related experts or estate agents, any service provided by way of grant of rights to use immovable property or for carrying out or coordination of construction shall be the location at which the immovable property is situated. (Section 12(3) of the IGST Act)

Q.16 What is the place of supply in respect of a service of interior decorator in relation to a palace in Nepal by an interior designer from Mumbai to a person from Delhi?

Ans. The place of supply shall be the location of recipient viz Delhi. (Proviso clause to section 12(3) of IGST Act)

Q.17 The place of supply in relation to immovable property is the location of immovable property. Suppose a road is constructed from Delhi to Mumbai covering multiple states. What will be the place of supply?

Ans. Where the immovable property is located in more than one State, the supply of service shall be treated as made in each of the States in proportion to the value for services separately collected or determined, in terms of the contract or agreement entered into in this regard or, in the absence of such contract or agreement, on such other reasonable basis as may be prescribed in this behalf. (The Explanation clause to section 12(3) of the IGST Act, for domestic supplies)

Q.18 What is the place of supply of services of accommodation services in homestays in Goa?

Ans. The place of supply shall be Goa, the location of the homestay. (Section 12(3) of the IGST Act).

Q.19 What would be the place of supply of services provided for organizing an event, say, IPL cricket series which is held in multiple states?

Ans. In case of an event, if the recipient of service is registered, the place of supply of services for organizing the event shall be the location of such person.

However, if the recipient is not registered, the place of supply shall be the place where event is held. Since the event is being held in multiple states and a consolidated amount is charged for such services, the place of supply shall be taken as being in each state in proportion to the value of services so provided in each state. (The Explanation clause to section 12(7) of the IGST Act)

Q.20 What will be the place of supply of goods services by way of transportation of goods, including mail or courier?

Ans. In case both location of supplier & location of recipient is in India: If the recipient is registered, the location of such person shall be the place of supply.

However, if the recipient is not registered, the place of supply shall be the place where the goods are handed over for their transportation (section 12(8) of the IGST Act.)

However, where the transportation of goods is to a place outside India, the place of supply shall be the place of destination of such goods (This proviso to section 12(8) has been inserted vide the IGST (Amendment) Act, 2018, however, the notification to bring it into effect is yet to be issued)

In case location of supplier or location of recipient is outside India: The place of supply of services of transportation of goods, other than by way of mail or courier, shall be the place of destination of such goods. For courier, the place of supply of services shall be the location of the recipient of services. Wherever the location of the recipient of services is not available in ordinary course of business, the Place of supply shall be location the supplier of service.

Q.21 A film star from Mumbai gets his cosmetic surgery done in a Hospital in Delhi. What should be the place of supply?

Ans. The place of supply shall be based on the principle of place of performance and shall be in Delhi. (Section 12(4) of IGST Act)

Other such similar services requiring physical presence of natural person (recipient) like restaurant and catering services, personal grooming, fitness, beauty treatment, health services including cosmetic and plastic surgery shall be the location where the services are actually performed.

Q.22 What will be the place of supply in case of training services provided in Goa?

Ans. When provided to a registered person: The place of supply shall be the location of such registered person. If M/s Mahindra & Mahindra Ltd, Mumbai conducts training for its employees at Goa, the place of supply shall be Mumbai.

When provided to a person other than a registered person: The place of supply shall be the location where the services are actually performed viz Goa

Q.23 What will be the place of supply of passenger transportation service, if a person travels from Mumbai to Delhi and back to Mumbai?

Ans. If the person is registered, the place of supply shall be the location of recipient. If the person is not registered, the place of supply for the forward journey from Mumbai to Delhi shall be Mumbai, the place where he embarks.

However, for the return journey, the place of supply shall be Delhi as the return journey has to be treated as separate journey. (The Explanation clause to section 12(9) of the IGST Act)

Q.24 Suppose a ticket/pass for anywhere travel in India is issued by M/s Air India to a person. What will be the place of supply?

Ans. In the above case, the place of embarkation will not be available at the time of issue of invoice as the right to passage is for future use. Accordingly, place of supply cannot be the place of embarkation. In such cases, the default rule shall apply. (The proviso clause to section 12(9) of the IGST Act)

Q.25 What will be the place of supply for mobile connection? Can it be the location of supplier?

Ans. For domestic supplies: The location of supplier of mobile services cannot be the place of supply as the mobile companies are providing services in multiple states and many of these services are inter-state. The consumption principle will be broken if the location of supplier is taken as place of supply and all the revenue may go to a few states where the suppliers are located.

The place of supply for mobile connection would depend on whether the connection is on postpaid or prepaid basis. In case of postpaid connections, the place of supply shall be the location of billing address of the recipient of service.

In case of pre-paid connections, the place of supply shall be the place where payment for such connection is received or such pre-paid vouchers are sold. However, if the recharge is done through internet/e-payment, the location of recipient of service on record shall be the taken as the place of service.

For international supplies: The place of supply of telecom services is the location of the recipient of service.

Q.26 A person in Goa buys shares from a broker in Delhi on NSE (in Mumbai). What will be the place of supply?

Ans. The place of supply shall be the location of the recipient of services on the records of the supplier of services. So Goa shall be the place of supply.

Q.27 A person from Mumbai goes to Kullu-Manali and takes some services from ICICI Bank in Manali. What will be the place of supply?

Ans. If the service is not linked to the account of person, place of supply shall be Kullu i.e. the location of the supplier of services. However, if the service is linked to the account of the person, the place of supply shall be Mumbai, the location of recipient on the records of the supplier.

Q.28 A person from Gurgaon travels by Air India flight from Mumbai to Delhi and gets his travel insurance done separately in Mumbai. What will be the place of supply of insurance service?

Ans. The location of the recipient of services on the records of the supplier of insurance services shall be the place of supply. So Gurgaon shall be the place of supply. (Proviso clause to section 12(13) of the IGST Act)

Q.29 A person from Gurgaon travels by Air India flight from Mumbai to Delhi and gets his travel insurance done in Mumbai. What will be the place of supply?

Ans. The location of the recipient of services on the records of the supplier of insurance services shall be the place of supply. So Gurgaon shall be the place of supply. (Proviso clause to section 12(13) of the IGST Act)

22.3 Place of Supply of Services (Location of supplier or recipient is outside India)

Q.30 What is the place of supply in respect of goods that are required to be made physically available for providing the service?

Ans. The place of supply of service in respect of goods that are required to be made physically available by the recipient of service to the supplier of service shall be the location where the services are actually performed. (Section 13 (3) (a) of the IGST Act, 2017)

Q.31 What is the place of supply of services provided from a remote location using electronic means on goods?

Ans. The place of supply shall be the location where the goods are actually located at the time of supply of services. (Proviso to Section 13(3) (a) of the IGST Act, 2017)

Illustration: A Laptop at Mumbai is repaired remotely by a software engineer from Bangalore using TeamViewer software. The place of supply shall be Mumbai, the place where the goods are located.

Q.32 Whether supplies by a banking company, or a financial institution, or a non-banking financial company, in Mumbai to its account holders in Dubai can be considered as export of service?

Ans. No. The place of supply of such services is location of supplier and therefore these cannot be considered as export of services. In the present case, the supplier being located in Mumbai and place of supply also in Mumbai, these services will be taxed and CGST plus SGST would be levied. [ Section 13(8)(a) of IGST Act]

Q.33 Who is an intermediary?

Ans. “intermediary” means a broker, an agent or any other person, by whatever name called, who arranges or facilitates the supply of goods or services or both, or securities, between two or more persons, but does not include a person who supplies such goods or services or both or securities on his own account.

Q.34 What is the place of supply of an intermediary?

Ans. The place of supply for intermediary services will be the location of supplier of service. It is to be noted that this rule will apply only when either the supplier or recipient is located outside India.

Q.35 What would be the place of supply in respect of services pertaining to goods transportation, wherein either the supplier or recipient is located outside India?

Ans. The place of supply of services of transportation of goods, other than by way of mail or courier, shall be the place of destination of such goods. (Section 13(9) of IGST Act)

For goods transportation via mail or courier, the default provision of Section 13(2) will apply i.e. place of supply will be the location of the recipient of service.

Q.36 What would be the place of supply in respect of Online Information and Database Access or Retrieval (OIDAR) Services?

Ans. For OIDAR services the place of supply will be the location of recipient of services. In case the recipient of OIDAR services is registered, he will pay Integrated tax on reverse charge basis. However, if the recipient is unregistered, the supplier will be liable to pay the tax. For the purpose of determining place of supply, the location of recipient of service shall be deemed to be in the taxable territory if any two of the following seven non-contradictory conditions are satisfied, namely: –

(a) the location of address presented by the recipient of services through internet is in the taxable territory;

(b) the credit card or debit card or store value card or charge card or smart card or any other card by which the recipient of services settles payment has been issued in the taxable territory;

(c) the billing address of the recipient of services is in the taxable territory;

(d) the internet protocol address of the device used by the recipient of services is in the taxable territory;

(e) the bank of the recipient of services in which the account used for payment is maintained is in the taxable territory;

(f) the country code of the subscriber identity module card used by the recipient of services is of taxable territory;

(g) the location of the fixed land line through which the service is received by the recipient is in the taxable territory.

Q.37 Whether the launch service provided by ANTRIX Corporation qualifies to be considered as export of services?

Ans. In terms of Section 13(9) of IGST Act, 2017, the place of supply of satellite launch service by ANTRIX Corporation to international customers would be outside India and wherever such supply qualifies all conditions specified under Section 2(6) of the IGST Act, 2017, would constitute as export of service and shall be zero rated.

Where satellite service was provided to a person in India, the place of supply of satellite launch service would be location of the recipient of services, provided the recipient is registered. In case where the recipient is not registered then place of supply is the place where such goods are handed over for their transportation.

(CBIC Circular No. 02/1/2017- IGST dated 27th September, 2017)

Q.38 What is the place of supply in case of supply of services relating to R&D, technical testing etc. to a person located outside India who sends the goods temporarily into India as the same are required by the supplier to provide the services?

Ans. In such cases, the general principle as per section 13(3)(a) is that the place of supply shall be the location where the services are actually performed. However, following proviso has been inserted to section 13(3)(a) vide the IGST (Amendment) Act, 2018. This amendment is yet to be brought into force.

However, in the case of services supplied in respect of goods which are temporarily imported into India for repairs or for any other treatment or process and are exported after such repairs or treatment or process without being put to any use in India, other than that which is required for such repairs or treatment or process, the default rule would be applicable i.e. the place of supply shall be the location of recipient of services.

Thus, in such cases, the place of supply shall be the location of recipient of services (Default provision in section 13(2)) i.e. outside India.

Q.39 How will the place of supply be determined wherein the goods are supplied from the premises of job worker?

Ans. The principal may supply, from the place of business/premises of a job worker on payment of tax within India. The place of supply would have to be determined in the hands of the principal irrespective of the location of the job worker’s place of business/premises.

Illustration: The principal is located in State A, the job worker in State B and the recipient in State C. In case the supply is made from the job worker’s place of business/premises, the invoice will be issued by the supplier (principal) located in State A to the recipient located in State C. The said transaction will be an inter-State supply. In case the recipient is also located in State A, it will be an intra-State supply.